Get ready to explore the gripping tale of inflation in the UK, spanning 75 years of ups and downs, as we uncover the strategies and implications for the economy.

Our Reader’s Queries

What was inflation like in the 1970s UK?

In 1970s, inflation reached a staggering 25%, the highest in British history since the Second World War. This was a moment of great fear for many, as they worried about the impact of striking unions. It was a time of uncertainty and concern, as people struggled to make ends meet in the face of rising prices. Despite the challenges, however, the British people remained resilient and determined, refusing to let inflation defeat them. With their characteristic grit and determination, they weathered the storm and emerged stronger than ever before. Today, we can look back on that difficult time with pride, knowing that we overcame adversity and emerged victorious.

What happened to the British economy in the 1970s?

Britain faced a daunting challenge in the 1970s as inflation and unemployment soared to unprecedented heights. The country was plagued by a series of strikes, power cuts, and states of emergency, all of which contributed to a sense of uncertainty and instability. Despite these challenges, the people of Britain persevered, demonstrating remarkable resilience and determination in the face of adversity. Through their unwavering spirit and tireless efforts, they were able to overcome the obstacles that stood in their way and emerge stronger than ever before. Today, we look back on this period as a testament to the indomitable human spirit and the power of perseverance.

When did UK inflation peak?

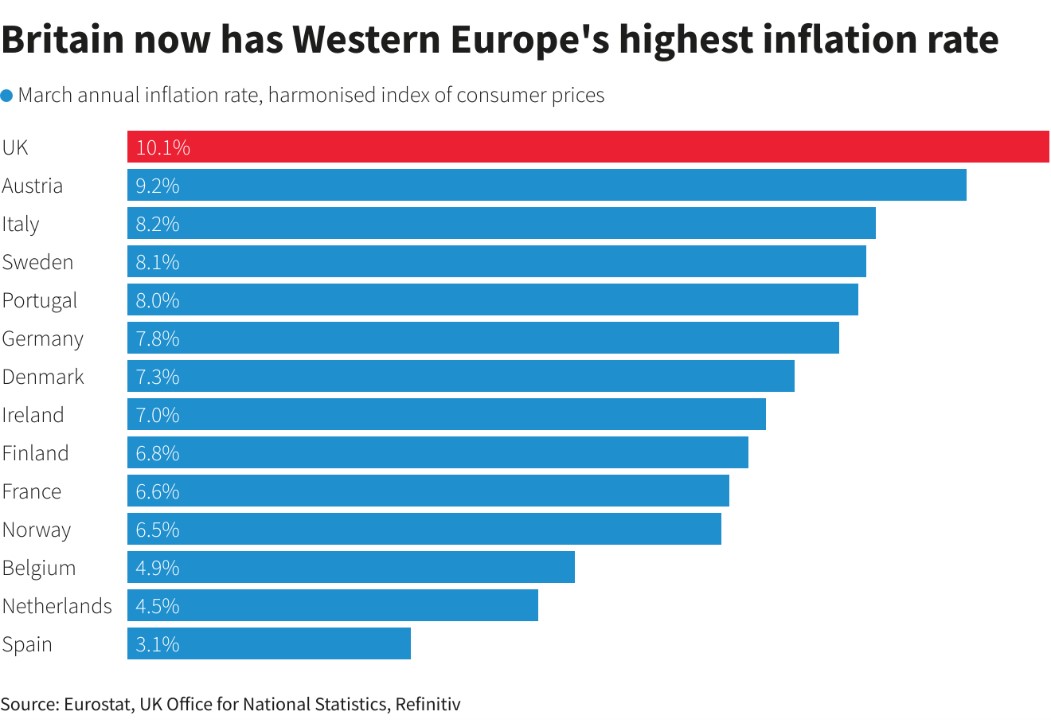

The mighty UK inflation is on a rapid descent! From its towering peak of 11.1% in October 2022, it has now plummeted to a mere 4.6% (annual CPI inflation in the year to October 2023). This is a testament to the heroic efforts of our economy’s guardians, who have valiantly battled against the forces of inflation to bring it under control. With this impressive feat, we can rest assured that our economy is in safe hands and that our future is bright. Let us celebrate this victory and look forward to even greater triumphs in the days to come!

Why was inflation so bad in the 1970s?

In the 1970s, the economy was plagued by a formidable foe – stagflation. This beastly combination of high inflation and uneven economic growth was fueled by a number of factors, including high budget deficits, lower interest rates, the oil embargo, and the collapse of managed currency rates. But fear not, for a hero emerged in the form of Federal Reserve Board Chair, Paul Volcker. With his unwavering determination, he raised the prime lending rate to a staggering 21% in order to vanquish the inflation dragon. And vanquish it he did, proving that even the mightiest of foes can be defeated with the right strategy and leadership.

Also Read : Endesa inaugurates a solar plant in Sanlúcar la Mayor

Read More News On The Conway Bulletin.